Inflation - Gold as a Hedge

Conventional wisdom is that when inflation is bad, you should buy Gold. The idea is that gold is a “store of wealth” with a traditional value for centuries. and its value has often held up well during times of high inflation. This is because gold is a scarce and valuable resource that is not subject to the same forces that can cause paper money to lose value. When the value of paper currencies falls due to inflation, the price of gold tends to rise as investors flock to it as a more stable store of value.

Intro and Review

As discussed in other articles, Inflation refers to a general increase in the cost of goods and services over time. When the price of everyday items such as food, clothing, and housing goes up, it means that the purchasing power of a given currency has decreased. Inflation can be caused by a variety of factors, including increasing demand for goods and services, rising production costs, and expansionary monetary policy.

One way that investors attempt to protect their wealth from the effects of inflation is by turning to gold. Gold has been valued as a store of wealth for centuries, and its value has often held up well during times of high inflation. This is because gold is a scarce and valuable resource that is not subject to the same forces that can cause paper money to lose value. When the value of paper currencies falls due to inflation, the price of gold tends to rise as investors flock to it as a more stable store of value.

The Relationship between Gold and Inflation

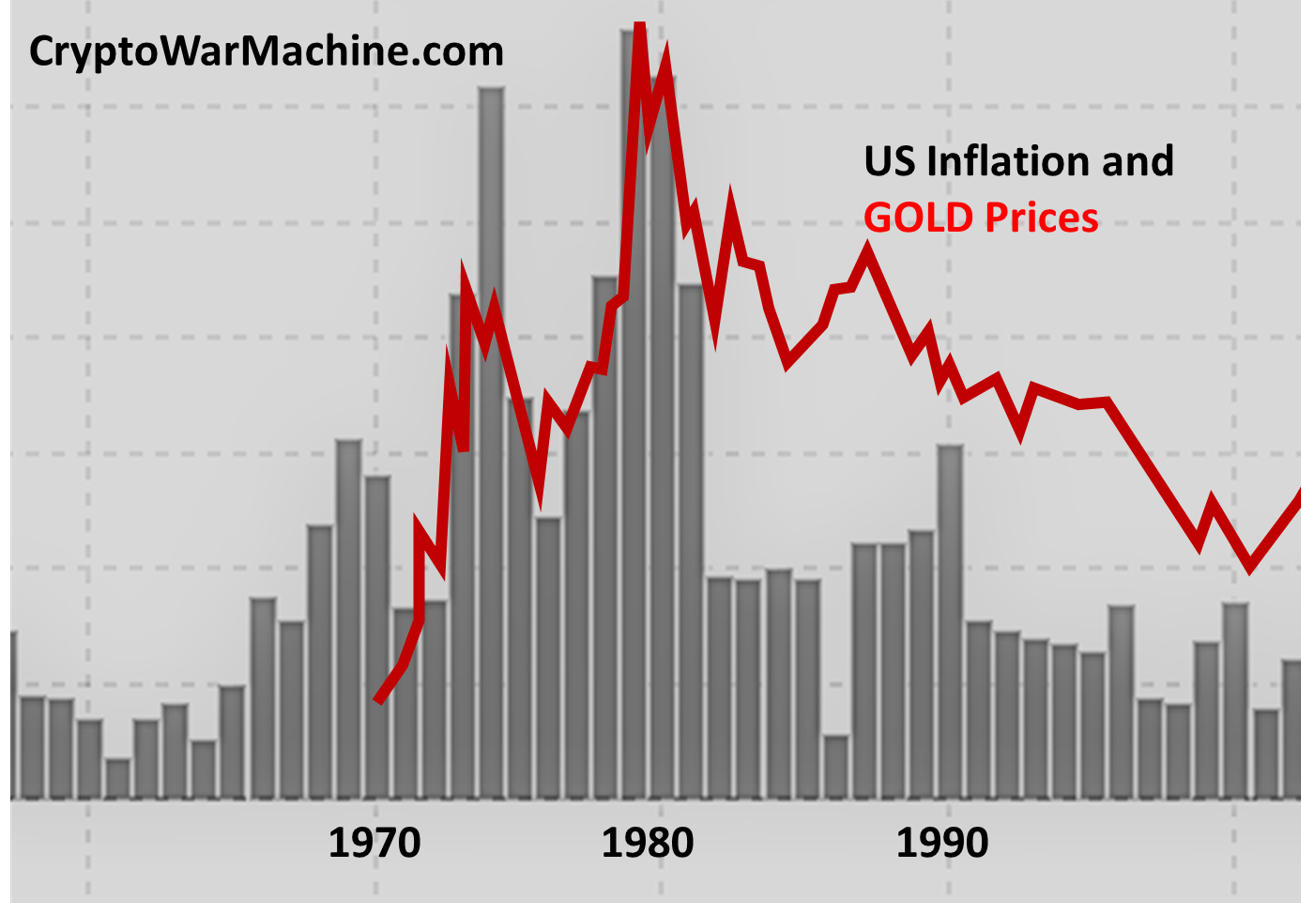

The relationship between gold and inflation has been apparent throughout history. During periods of high inflation, the price of gold has often increased significantly. For example, during the 1970s, when the United States experienced high levels of inflation, the price of gold skyrocketed from around $35 per ounce to over $800 per ounce. This skyrocketing price in the 70s is the primary thing people will quote when they talk about gold as the hedge against inflation. We will talk more about this in a bit.

There are several theories as to why gold would work as a hedge against inflation.

One reason is that gold is a scarce resource, with a limited supply that cannot be increased at will. This makes it less susceptible to the kind of devaluation that can occur when a government increases the money supply in an effort to stimulate the economy.

Gold is also seen as a "safe haven" asset, meaning that it is considered a relatively stable investment that can hold its value during times of economic uncertainty. This is probably not actually true - as we will discuss later.

Another reason why gold is viewed as a hedge against inflation is that it has a long history of being valued as a store of wealth. Throughout history, gold has been used as a medium of exchange, and it has maintained its value over time in a way that other forms of currency have not. This perceived value is often enough to drive demand for gold during times of economic uncertainty or high inflation.

What is Gold’s Historical Track Record as an Inflation Hedge ?

In the 1970s there was an oil crisis that when combined with other factors resulted in out-of-control inflation. The 1980s also saw high inflation rates. Lets look back at those periods and see how good gold really is as a hedge against inflation.

1973-1979: Inflation = 8.8% , Gold had a 35% annualized return. Gold built its reputation during these 6 years as the super star inflation buster.

1980-1984: Inflation = 6.5%, Gold prices FELL 10% on average per year. Returns not only fell short of the inflation rate, but they also underperformed the S&P 500

1988-1991: Inflation = 4.6%, Gold prices FELL 7.6% on average per year

Is the Value / Price of Gold Stable ? Can it hold its value during times of economic uncertainty ?

If we look at Gold and its ratio to CPI (a tool to measure inflation) we can get some good data. If Gold were a simple, reliable hedge against inflation, its value would remain roughly constant relative to the CPI — spoiler, it doesn’t. If we look at the “medium-term” period of 1980 to 2001,the price of gold adjusted for the CPI decreased more than 80 percent !

When you look at all the data you can draw two conclusions:

1) Gold actually fluctuates a lot - and over small and medium time frames it isn’t great for “holding its value:

2) Over the long haul — like 100 year periods, Gold actually does hold its value.

As an investor, typically 100 year investment points are what you are thinking about. Generational wealth is certainly a consideration, but combatting fear and uncertainty is typically a more short or medium time frame concern.

How to invest in Gold

I realize that it sounds like I’m crapping all over Gold. I’m not trying to do that. I’m trying to have an honest look at the numbers. For many people this is still an important part of their portfolio, so lets talk about the options to invest in it (remember nothing I say is financial advice - do your own research).

Physical gold:

This can include gold bullion or coins, which can be purchased from a variety of dealers and stored in a safe place. Physical gold is a tangible asset that can be held in your hand, and it is generally considered to be a relatively safe investment. However, it can be expensive to buy and store large amounts of physical gold, and it may not be suitable for smaller investors.

Performance: In the last 30 Years, gold had average annual returns of 7.78 percent

Gold ETFs (Exchange Traded Funds):

These are investment funds that track the price of gold and can be bought and sold like stocks. Gold ETFs are a convenient way to invest in gold without having to physically hold the metal, and they can be a good option for smaller investors. However, they may not offer the same level of security as physical gold, as they are subject to the same risks as any other investment.

Performance: In the last 30 Years, the SPDR Gold Trust (GLD) ETF obtained a 5.56% compound annual return

Gold mining stocks:

These are stocks in companies that mine for gold. Investing in gold mining stocks can be a more risky option than investing in physical gold or gold ETFs, as the value of the stock is dependent on the success of the company as well as the price of gold. However, it can also offer the potential for higher returns if the company is successful.

Performance: This is going to depend alot on the company and year to year issues. Most years they are in the green. You can look at the data on “GOLD” here — LINK

When choosing how to invest in gold as a hedge against inflation, it's important to consider the pros and cons of each option. Physical gold is a tangible asset that can be held in your hand, but it can be expensive to buy and store. Gold ETFs are convenient and easy to buy and sell, but they may not offer the same level of security as physical gold. Gold mining stocks can offer the potential for higher returns, but they are also riskier than other options.

Regardless of which option you choose, it's important to do your research and carefully consider the risks and potential rewards of any investment. It's also a good idea to diversify your investment portfolio to spread risk and potentially increase your chances of success.

Wrap Up

Gold did great in the 70s. Overall - there are probably better ways to manage risk in the short and medium term. I’ll be discussing those (bonds and real estate) and some other interesting topics like Executive Order 6102 in upcoming articles. Remember to do your own research before investing. Knowledge is power.