Inflation - Relationship with Employment

As the rate of inflation rises, it can have a profound effect on the job market, leading to increased unemployment levels.

Introduction to Inflation, Wages, and Prices

Inflation affects both wages and prices, which are key components in the labor market. When prices rise, employers are unable to increase wages without also negatively affecting their bottom lines. This reduces workers' incentive to work as they face stagnant wages or even pay cuts due to rising costs of living. Furthermore, if employers choose to raise wages in order to remain competitive with similar businesses, they may be forced to reduce staff levels or hire fewer new employees in order to maintain their budget.

The impact of inflation on employment can be further exacerbated when the rate is high enough that people are wary of spending money on products or services that would help stimulate economic growth. In such cases, consumer demand falls and businesses suffer financially, thus resulting in layoffs or cutbacks in hours worked by already employed individuals.

High inflation not only leads to fewer job opportunities for those who are seeking employment but also hurts those who already have positions since their wages do not keep up with increasing costs of living when prices rise faster than incomes do. Consequently, it is essential for governments to monitor inflation rates and take measures to ensure that this important metric does not spiral out of control.

Labor Supply and Demand

Labor supply and demand is a key economic concept that affects the job market. The law of supply and demand states that when there is an abundance of labor in the market, wages will drop as employers can easily find qualified workers; while the opposite occurs when there is a shortage of labor.

When it comes to labor supply and demand, certain conditions affect the job market more than others. For instance, changes in technology can cause a shift in labor supply as fewer people are needed to perform certain tasks due to automation or new processes. On the other hand, changes in population size or demographics can have an impact on labor demand as companies may need to hire more workers depending on their target demographics.

It is important for governments and employers alike to be aware of how shifts in labor supply and demand will affect their respective industries. In addition, understanding these concepts can help both sides create policies that maximize economic efficiency without sacrificing results or job security for employees. By creating a balance between the two, businesses and governments can ensure sustainable growth for both parties.

The Phillips Curve

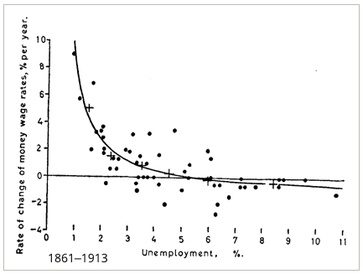

The Phillips Curve is an economic theory which shows the relationship between unemployment and inflation. According to the Phillips Curve, when inflation increases, unemployment decreases, and vice versa. This inverse relationship between unemployment and inflation makes up the basis of this economic theory.

The original curve drawn for pre-WW1 data

Implications of the Phillips Curve:

The Phillips Curve illustrates how changes in monetary policy can impact the labor market by affecting wages and prices.

When a central bank increases or decreases interest rates, it positively or negatively affects wages, respectively. This change in wages will then cascade down to other areas of the economy such as employment levels and consumer spending.

The curve suggests that governments can use monetary policy to influence the labor market by adjusting interest rates and controlling inflation. By doing so, unemployment levels can be managed in order to ensure a healthy job market in the economy.

The Phillips Curve also implies that governments should strive for a balance between unemployment and inflation in order to minimize economic risks associated with large fluctuations in either variable. When there is too much inflation or too little unemployment, it can lead to instability which can impact long-term economic growth in an unfavorable way. Therefore, it is important that governments understand how the two variables interact with each other and fine-tune their policies accordingly.

Finally, the Phillips Curve suggests that there is a trade-off between reducing unemployment and keeping inflation low. This means that even though it may seem tempting to reduce unemployment by any means necessary, if inflation rises too quickly this could cause further economic damage down the line. It is thus important for governments to take into account these implications when crafting their macroeconomic policies.

Monetarist criticism of the Phillips Curve

TLDR: Monetarists believe that macroeconomic policies should focus on controlling money supply rather than targeting wage levels or employing other methods suggested by the Phillips Curve theory.

In the late 1960s and early 1970s, economists Milton Friedman and Edmund Phelps developed a new theory that contradicted the Phillips Curve — one which stated that there was no trade-off between inflation and unemployment. Their theory was confirmed during the economic crisis of the 1970s, when high unemployment coexisted alongside high inflation despite policymakers attempting to reduce both.

This helped solidify their argument about the lack of a trade-off between inflation and unemployment, and laid the foundation for Monetarism as an economic school of thought. The fact that the crisis had occurred despite authorities’ attempts to control prices using traditional Phillips Curve methods served as further proof that this approach was ineffective.

Monetarists had long been critical of the Phillips Curve theory, often calling it stupid and saying that Phillips ate his own poop.

“Hey! I don’t eat my own poop!” - Phillips

Monetarists also criticize the idea that economic managers can influence unemployment through controlling inflation, as the Phillips Curve suggests. They argue that this would lead to higher prices and more money in circulation, which would only add to inflationary pressures in the economy without actually reducing unemployment.

Furthermore, Monetarists claimed that the Phillips Curve does not factor in supply and demand dynamics which play an important role in determining wages and labor costs. This means that its predictions may be inaccurate or misleading when applied to certain scenarios.

CPI vs. Unemployment

There is an important distinction between Consumer Price Index (CPI) and unemployment when it comes to macroeconomic indicators. The CPI measures the average change in price of a basket of goods and services over time, providing an indication of inflationary pressures in the economy. Unemployment, on the other hand, tracks the rate at which people are without jobs. These two measures are both key indicators of economic health, though they offer different insights into the state of a given economy.

CPI and unemployment can move in different directions over time. While higher inflation usually leads to increased unemployment due to reduced consumer spending power, this does not always hold true — as seen in some cases during the 1970s where high inflation coexisted with high levels of unemployment despite authorities attempting to reduce both. This dynamic is known as stagflation and emphasizes the importance of tracking both CPI and unemployment metrics when trying to understand an economy’s health.

The Sacrifice Ratio

The sacrifice ratio is a measure of the economic cost incurred in order to reduce inflation. It is calculated as the percentage of lost output which must be endured in order to reduce the inflation rate by one percent.

Sacrifice Ratio = Percentage Reduction in Economic Output Per 1% Decline in Inflation Rate

The concept was developed by economist Robert J. Gordon and later expanded upon by economists Edmund Phelps and Milton Friedman in their research into how best to combat high levels of price inflation.

The sacrifice ratio is an important metric for policymakers, who need to evaluate the costs and benefits associated with various anti-inflationary policies. In practice, higher sacrifice ratios suggest that achieving a given reduction in inflation will require greater economic disruption — something which authorities may not wish to do if they think other policy measures could be more effective or less costly. A proper understanding of the sacrifice ratio can therefore help governments make informed macroeconomic decisions.

“Great Expectations” - Rational Expectations Hypothesis and the Lucas Critique

The Rational Expectations Hypothesis (REH) and the Lucas Critique are both important concepts in macroeconomics. The REH states that people’s expectations about the future are formed on the basis of their experiences in the past. This means that economic decision makers assume that policies will have similar outcomes in the future as they did in the past, based on their accumulated knowledge about the economy and how it responds to different measures.

The Lucas Critique is an application of the REH which argues that policy initiatives should take into account new knowledge acquired by agents over time so as to be effective. For example, it suggests that governments must consider how people’s expectations may change if a given policy is implemented — since people tend to update their expectations according to new information they receive — or else face potential policy failure. It also posits that policies which worked well in history may not work in current conditions due to shifts in individual beliefs, further emphasizing the importance of an adaptive approach when making macroeconomic decisions.

Conclusion

In the short run, the trade-off between unemployment and inflation reduction occurs, but not in the long run, because people need time to adjust to changing inflation rates. Central banks try to control inflation through monetary policies — they sometimes help, and other times make it better, but they are at least trying based on some economic theory. The trade-off between unemployment and inflation could probably be mitigated if people had better information about future inflation so that they could compensate for changes in inflation more quickly.